On 28 February 2024, hot on the heels of Nigeria’s credit outlook change to positive by Moody’s Ratings (Moody’s), U.S Consul General to Nigeria, William B. Stevens, hosted a reception in honour of 100 Women in Finance (100WF) and Moody’s.

Following welcome remarks by Consul General Stevens and Julie LeBlanc, U.S. Commercial Counsellor to Nigeria, Taiwo Okwor, Co-Chair of the 100WF Nigeria Committee and Vice President (Natural Resources Investment) at the Africa Finance Corporation, opened the session.

Isabella Burke, Vice President, Relationship Manager and Country Manager for Moody’s in South Africa, and a member of the 100WF South Africa committee, introduced Lucie Villa as a keynote speaker for the event. Lucie is the Vice President and Senior Credit Officer of Global Sovereign Risk at Moody’s, and the lead analyst for Sub-Saharan African sovereigns and supranational issues. In her presentation looking at Nigeria’s Credit, Lucie highlighted the impact of inflation, debt affordability and what it takes to improve price stability and government revenue using major global economies as comparators.

The event concluded with remarks from Yemi Okojie, Co-Chair of the 100WF Nigeria Committee and Head of Strategy and Corporate Development at FBN Holdings Plc, who thanked the Moody’s and US Consulate teams for their kind support in ensuring the event’s success and encouraged participants to stay updated on upcoming 100WF Nigeria events.

The event facilitated an engaging and insightful discussion among attendees, which included senior leaders in Nigeria’s financial services sector, global DFIs such as the U.K.’s development finance institution (BII), Dr. Rebecca Lisner, Deputy National Security Adviser to the Vice President of the United States, U.S. diplomats, and 100WF members.

Scroll down to read an article about the event and for photos.

As attendance was limited, this article shares some insights and highlights from the session. All the statements are as of 28 February 2024, they are the views and opinions of the author and do not reflect the views of 100WF or the US Government. All of the statements will not be updated or supplemented.

Summary of Moody’s Credit Outlook on Nigeria

In December 2023, Moody’s revised its outlook on Nigeria from stable to positive, citing possible reversal of the deterioration in the country’s fiscal and external position thanks to bold reform efforts by the Administration of President Bola Tinubu, which include currency devaluation, removal of the costly fuel subsidy, and the lifting of certain import bans.

The reforms, which have led to soaring costs and double-digit inflation, eroding savings and incomes in Nigeria, clearly indicate that the road to prosperity will be long and difficult.

When reassessing, typically within 12 – 18 months following the change in outlook Moody’s will review the following key areas, which are outlined in more detail below: inflation, debt affordability, price stability and government revenue.

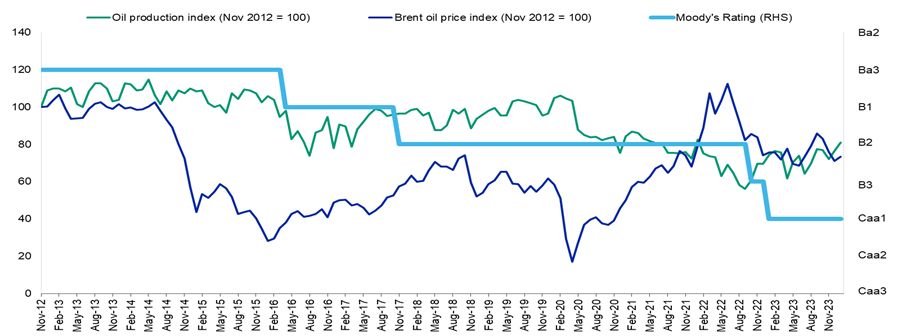

Nigeria’s Rating History: Nigeria’s credit profile has deteriorated over time, in line with weakening oil revenues, at times driven by price, but recently by depressed oil production capacity. Nigeria’s institutional weakness is also a long-standing credit constraint.

Source: Moody’s, Haver

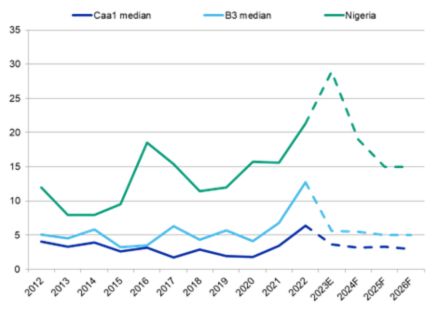

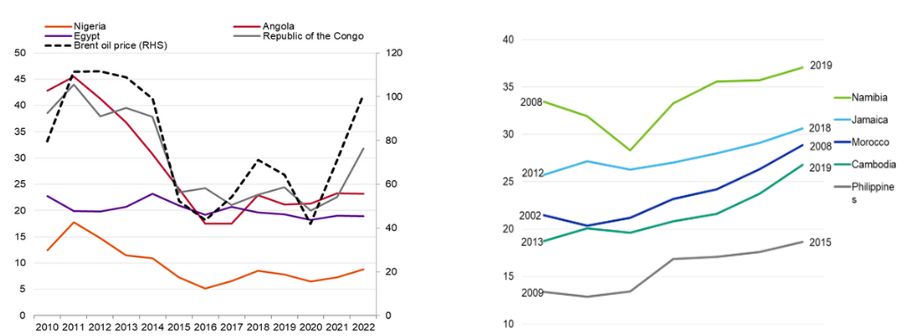

Nigeria’s Inflation and Debt Affordability vs. Peers: Moody’s expects Nigeria’s inflation to remain higher than rating-level peers. Fighting hyperinflation is therefore the number one priority for the Nigerian government, in order to reduce insecurity and growing social risks. However, this will require an arbitrage with economic activity and, to a degree, financial stability.

Figure: Inflation rate

Source: Moody’s

Figure : Government revenue/GDP

Source: Moody’s

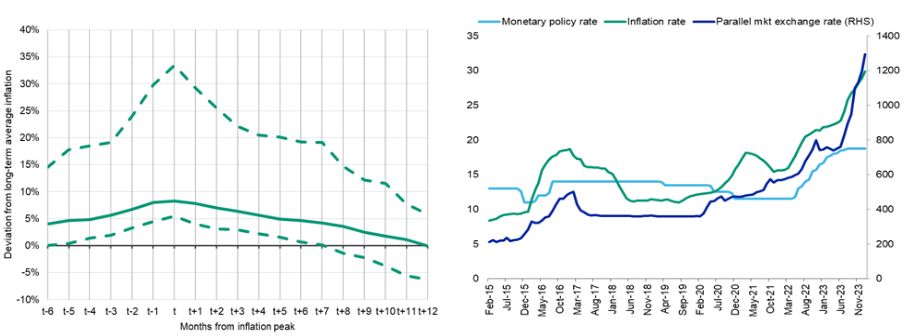

Restoring Price Stability: Inflation shocks take time to subside. We know from over 100 episodes of high inflation in emerging markets that it took 12 months on average to return to the historical average from peak inflation. Nigeria is experiencing extremely elevated levels of inflation that have yet to peak. While inflation took 18 months to stabilise after the January 2017 peak in Nigeria, forecasts show that this episode of will take longer, around two to three years from the peak, which is expected during 2024.

LHS: Calculated from a panel of 114 emerging market inflation shock episodes between 2010 and 2023. In episodes identified, inflation peaks at ≥5ppt higher than long-term average.

Source: Moody’s, Haver

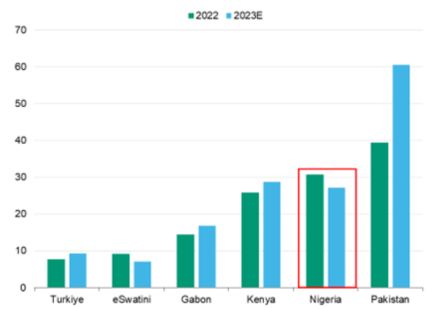

Improving Government Revenue: While limited data makes it difficult to fully appreciate Nigeria’s fiscal policy stance or determine the exact gross consolidated government revenue in Nigeria, we know that Nigeria’s government revenue is persistently below peers and mostly consumed by debt service. Compared to its African peers, Nigeria’s economy is large, yet income levels are low.

It becomes difficult to finance proper policy if the government spends more than one-third of its low revenue paying creditors. In order to finance policy that will boost the Nigerian economy while continuing to service debt going forward, the Nigerian government will need to augment its revenue through increased tax rates, trade agreements and other measures, taking lessons from Namibia, Morocco, the Philippines and Cambodia.

Source: Moody’s

Written by:

Saratu M. Kitchener, Africa Finance Corporation and 100WF Nigeria Vice-Chair

Reviewed by:

Julie LeBlanc, U.S. Commercial Counsellor to Nigeria

Isabella Burke, Moody’s Ratings and 100WF South Africa committee member

Taiwo Okwor, Africa Finance Corporation and 100WF Nigeria Co-Chair

Yemi Okojie, FBN Holdings Plc and 100WF Nigeria Co-Chair