Insights from a recent event organised by the 100WF South Africa Committee in Johannesburg

Ahead of COP27, and hot on the heels of South Africa’s Medium Term Budget speech, on 26 October, 2022, the U.S Consul General to Johannesburg, Vincent Spera, hosted a reception in honour of 100 Women in Finance (100WF). Mali Aurelien from Moody’s spoke on the very topical theme of the evening, the Investment Climate in South Africa, giving a comprehensive overview of South Africa’s macroeconomic trends, sustainability position, and as well as current challenges and opportunities for the economy. 100WF South Africa committee members Sarah Whitten from the U.S. Trade and Development Agency and Isabella Burke from Moody’s led the event, together with the 100WF South Africa committee chair: Janice Johnston. Senior attendees across the financial services sector in South Africa, as well as large U.S. corporates and U.S. diplomats, had the opportunity to engage on this important topic. As attendance was limited, this article shares some insights and highlights. This event was one of several organised by 100WF’s South Africa committee in 2022. 100WF has a full program of exciting events being planned for 2023 in South Africa and globally.

As the event had a limited capacity this article is a summary of some of the insights from the session. All the statements are the views and opinions of the author, and do not reflect the views of 100WF. All of the statements are as of 6 December 2022 and will not be updated or supplemented.

A Just Transition: During the World Leaders Summit at COP27 on 7 November, 2022, South Africa’s President Cyril Ramaphosa launched the new Just Energy Transition Investment Plan prepared by the South African government as envisaged in the Political Declaration. This follows the initial commitment made in 2021 by the governments of the United States, United Kingdom, France, Germany, and the EU, of a USD 8.5 billion commitment towards South Africa’s emissions reduction and decarbonization efforts. The Plan uncovered at COP27 covers three priority sectors that require financing – namely the energy sector, electric vehicles and green hydrogen. A ‘Just’ approach underpins the Plan, aiming to ensure that those most directly affected by a transition from coal – workers and the communities these workers support, including women and girls – are not left behind. South Africa’s Investment Plan identified USD98 billion in additional financing requirements from both public and private sectors, over five years to achieve South Africa’s 20 year energy transition.

South African Investment Environment Primed for Growth: South Africa’s business environment benefits from its diverse industrial and service base, credible monetary policy framework alongside the large and globally-connected banking and financial services. The South African government offers various investment incentives targeted at specific sectors or types of business activities and has a number of existing incentive programs ranging from tax allowances to support new industrial projects including in the automotive sector and labour-intensive manufacturing sectors, as well as creative sectors including innovation, media, and technology companies.

Investment Mobilisation: Focus on Infrastructure

From an investor perspective, it is clear that the key areas to sustainably help drive the transition of South Africa’s economy up the value chain include: clarity in reliable energy access, improvements in transport logistics, reforms aimed at boosting labour participation, and improvements to the legal and security environment. According to President Ramaphosa, now more than ever, the economy needs robust foreign investment geared towards a sustainable and equitable future. The president also emphasised the significant opportunity for private capital to invest in South Africa’s energy transition. Looking ahead, further regional integration combined with the implementation of pro-business reforms could set the country apart amongst its peers in the AfCFTA and more broadly across the continent.

Unemployment and Labour: The official unemployment rate, as of Q3 2022, was reported at 32.9%, and latest data showed that 47.0% of South African women were recorded as economically inactive, according to StatsSA (Q2 2022). This means that almost half of the working age women in South Africa are out of labour force compared to 35.6% of their male counterparts. The challenges are more pronounced amongst the youth population. Longer-term initiatives geared towards improving education, particularly for young females, ought to be a key priority in order to reduce inequality and poverty in the country. A productive workforce with high employment is the backbone of a strong and investable economy. In addition, sustainable investment growth in a South African context will require investors to look at environmentally and socially conscious bankable projects.

The productive potential of South African women in the labour market remains unused. Equipping women to enter the workforce yields dividends as an additional driver of economic growth. Both the public and private sector have a role to play in boosting the security environment, providing further childcare support, increasing workforce training programs for women, boosting gender equality in decision-making roles, and capacitating relevant departments to support the needs of women in the work force.

Key Opportunities for Investors:

Given the keen focus from the global community on the Just Energy Transition in South Africa, we expect to see a high degree of bankable projects in the sector in the coming years. Additionally, infrastructure continues to require high levels of investment. Finally, South Africa houses a strong start-up sector which continues to produce innovative business models, and businesses that successfully support the burgeoning middle class are likely sources of sustainable growth. Whilst emerging markets present risk and commensurate reward, and South Africa continues to grapple with a challenging operating environment, it is uniquely positioned with various opportunities for a savvy investor. Key industries being targeted for private sector investment include finance, technology, insurance, real-estate, business services, logistics, manufacturing, mining, electricity, water and agriculture and we see considerable scope for women to engage in this drive.

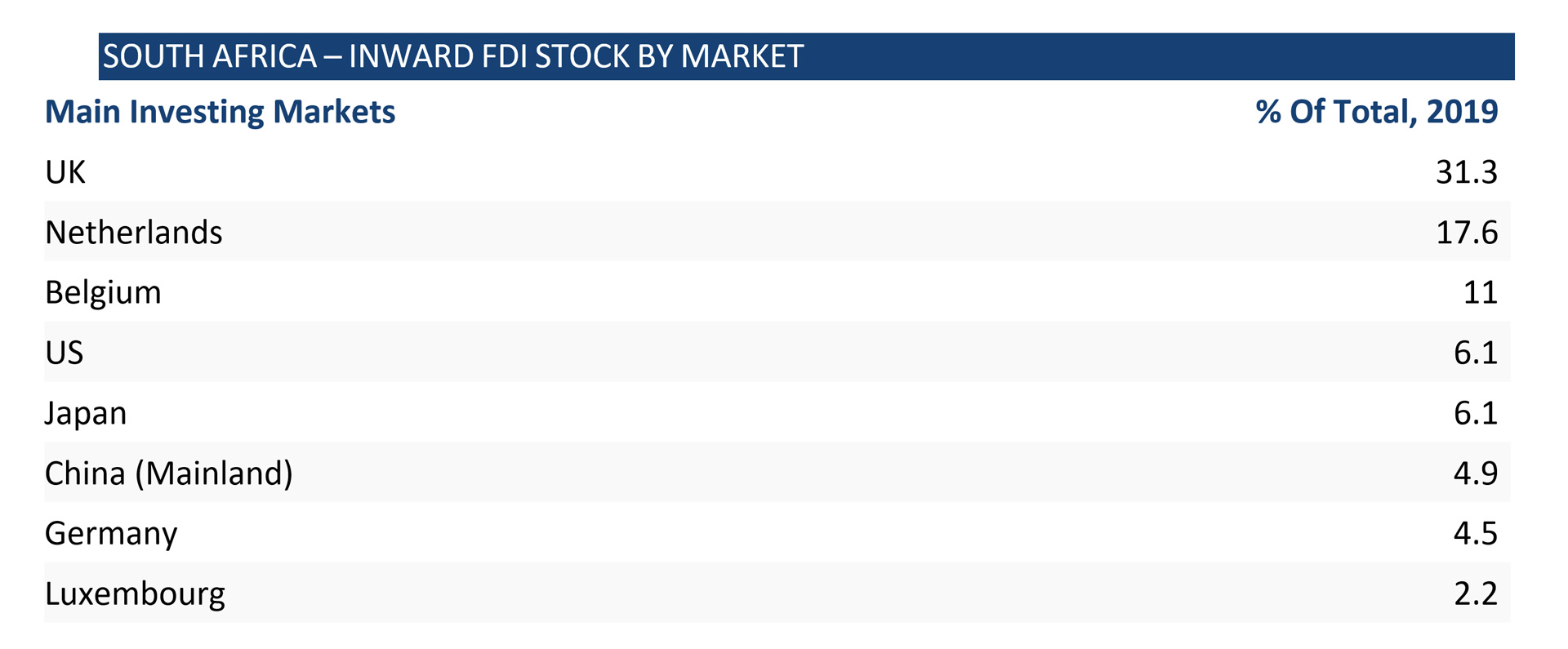

The potential attractiveness of South Africa is high compared with other countries in the region, where the country accounted for an average of 10.5% of the total inward FDI flows into Sub-Saharan Africa. However, its performance is relatively weak for FDI attraction when compared with global emerging markets and BRICS peers. Most foreign direct investment in South Africa is in the tertiary, or services, sector (over 58% share in 2019), followed by the primary (25%) and secondary sectors (16%).

Source: ITC-Investment Map

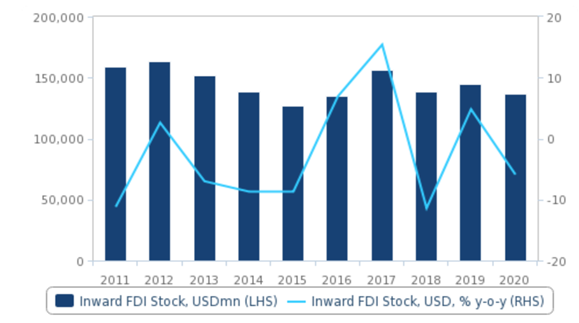

Inward FDI flows have further room to grow.

Chart: South Africa – Inward FDI Stock (2011-2020)

Source: UNCTAD

Written by:

Chiedza Madzima, 100WF South Africa committee member

Head of South Africa Research & Operational Risk, Fitch Solutions

Edited by:

Sarah Whitten, 100WF South Africa committee member

6 December 2022